In a letter submitted to the record by the US Senate Subcommittee on Antitrust currently investigating Big Tech, Luigi Zingales expounds on the Stigler Center’s policy recommendations on how to address the market power of the largest tech platforms.

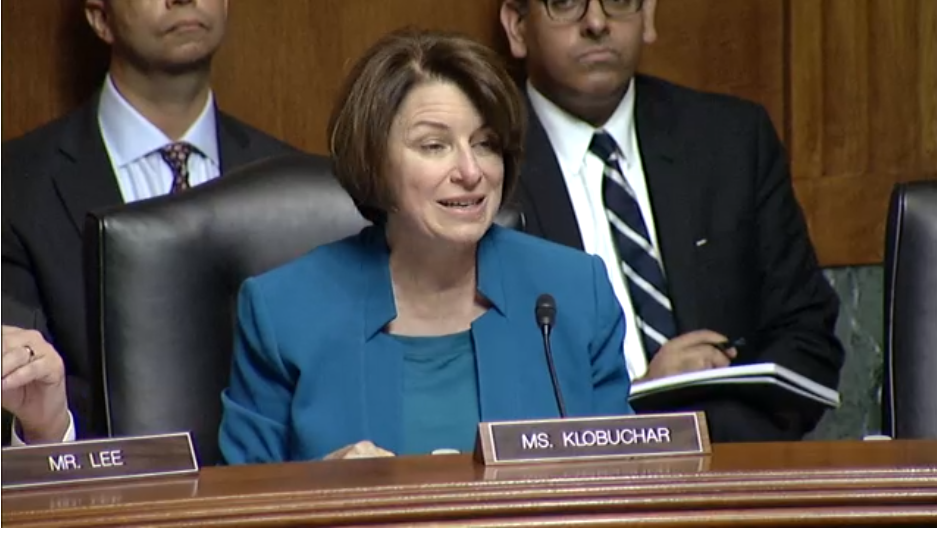

Editor’s note: The US Senate’s Subcommittee on Antitrust is investigating the market power of the largest tech platforms. In its second hearing earlier today (Tuesday), Senator Amy Klobuchar (D-MN), the ranking member on the subcommittee, asked to submit to the record a letter by Luigi Zingales, the Stigler Center’s faculty director. Chairman Mike Lee (R-UT) agreed. You can read the full letter below:

Chairman Lee and Ranking Member Klobuchar,

We commend you on committing to this investigation on Competition in Digital Technology Markets. While generating many great benefits, digital technology has also created new challenges. Governments around the world (from Australia to the European Commission, from the United Kingdom to the BRICS countries) have commissioned reports to explore what these challenges are and how societies can deal with them. The United States government has yet to do so.

The Stigler Center at the University of Chicago Booth School of Business has helped to fill this vacuum by convening the Stigler Committee on Digital Platforms. For over a year, 30 independent academics and experts studied the impact of digital platforms on four dimensions: economy, privacy, media, and politics. In doing so, the Committee was instructed to carefully consider the value created by these companies. The goal was not to return to a world without Google or Facebook; but to ensure that these companies continue to exist, innovate and generate value in a way that benefits our societies.

The final report of the Committee, released in September 2019, probably represents the most in-depth, independent study of digital platforms to date. Given the hearing’s focus on how digital platforms’ acquisitions of nascent competitors impact markets, in this letter I will focus on three topics:

1) why the recurrent acquisition of nascent competitors harms competition;

2) why lack of competition in this market has very pernicious effects not just consumer welfare, but on privacy, information, and even democratic values;

3) what can be done to obviate this problem. These are only some of the topics addressed in the Stigler Committee’s report, which I encourage you and others interested to read.

Recurrent Acquisitions Harm Competition

Digital markets present many economic features that make them uniquely prone to monopolization by a single company. These markets are often characterized by strong economies of scale and scope, due to low marginal costs and increasing returns to data. Moreover, they are often two-sided and have strong network externalities, making them prone to tipping—after a short period of competition, a single firm acquires the necessary scale and dominates the market. When markets “tip,” the threat of displacement by new companies (“market entry”) is crucial to ensure that digital platforms continue to innovate and serve consumers.

Unfortunately, as the Stigler Report documents, entry into digital markets dominated by incumbents such as Google and Facebook is very difficult. A new company cannot generally overcome the barriers to entry present in these markets without either a similar installed base (network effects) or a similar scale (scale economies), both of which are difficult to obtain quickly and cost-effectively. Control over large unique datasets is another barrier to entry, along with the ability to manipulate consumer choice through framing and defaults, set restricting interoperability rules and constrain consumers’ ability to multihome.

In the last 10 years, Google has acquired at least 175 companies; Facebook has acquired at least 70, the overwhelming majority without any form of regulatory scrutiny. In competitive markets, acquisitions of innovative startups stimulate innovation by rewarding good ideas: to acquire potential competitors, incumbents would have to pay at least what these competitors would be able to fetch alone. By contrast, in monopolized markets, the same is not true.

First, by positioning themselves as a mandatory bottleneck between new entrants and customers, digital platforms play the role of the traditional robber barons, who exploited their position of gatekeepers to extract a fee from all travelers. Not only does this fee represent a tax on innovation, it also reduces the value new entrants can fetch alone and thus the price at which they would be acquired.

Second, in a world with switching costs, new entrants with a superior technology will find it difficult to attract customers, as customers expect that any superior technology will be incorporated by the incumbent platform after an acquisition. This expectation reduces the number of customers new entrants can obtain and thus the price at which these new entrants will be acquired, further reducing innovation incentives.

These problems are sufficiently important that venture capitalists talk about a “kill zone”, or an area of technology where they avoid investing in innovative startups because they fear the competition with incumbent digital platforms.

“We want to reduce the harmful effects of digital platforms without reducing the enormous benefits they bring.” Luigi @zingales on the release of the new @StiglerCenter

“Stigler Committee on Digital Platforms Policy Brief” #StiglerReport @UChicago: https://t.co/r2AjLv9DM5— Stigler Center (@StiglerCenter) September 17, 2019

The Lack of Competition Harms our Society

The Stigler Report details how this “kill zone” negatively impacts our society in many different ways. The first and most worrisome effect is reduced innovation; a growing body of scholarship is documenting reduced start-up formation and innovation in key digital markets where digital platforms operate. The second is high markups in the advertising market, which are then passed along to consumers. In addition, the lack of entry threat allows digital platforms to ever-expand their dominance to adjacent markets and to use the enormous amounts of personal data they control to exploit behavioral biases and constantly increase their profit margins to consumers’ detriment.

These include: (i) ensuring that users remain “hooked” to the platforms—a zero-sum game for our attention that negatively impacts our well-being; (ii) offering particular products when customers are vulnerable, making them regret choices afterwards; and (iii) the constant use of dark patterns—user interfaces that manipulate users into taking actions that do not align with their preferences or expectations. Consumers’ main defenses against some of these pernicious practices is to go to a competitor, but unwavering market dominance enables digital platforms to behave without fear of losing clients.

The harms produced by the durable market power of digital platforms, however, go beyond the usual considerations on consumer welfare and market innovation. The Stigler Report documents how:

- This supremacy leads to less personal privacy: When Facebook was competing with MySpace, it advertised its protection of consumers’ privacy. The company then became much more aggressive in harvesting personal data once it became dominant.

- This power also restricts our access to information and our ability to independently form our own opinions: By using obscure algorithms to curate the news and information users receive, digital platforms are appropriating the role newspaper editors had in influencing readers’ attention. Thousands of different viewpoints are now being replaced by a duopoly. This concern is exacerbated by the fact that editing is solely aimed at maximizing viewers’ time on the platform, often through the prioritization of extreme, misleading, or divisive content.

- Finally, this dominance is increasingly impacting our political arena: Digital platforms’ financial resources, media power, complexity, membership power, and ability to paint themselves as “national champions” have turned them into extremely powerful political actors. Digital platforms such as Facebook and Google combine the key political traits of ExxonMobil, The New York Times, JPMorgan Chase, the NRA, and Boeing. Thanks to nonvoting stock, all this combined power rests in the hands of just three, unaccountable individuals.

Thus, this concentration of economic, media, data, and political power threatens our well-being and the functioning of our democratic institutions. Immediate action is required to reestablish balance.

We Must Take Action

The benefits brought about digital platforms allowed them to develop almost free of any form of government oversight. At this stage, the risks of not intervening seem to exceed the possible costs of intervention. Strengthening competition is crucial. Digital markets present particular challenges for antitrust enforcement. Markets tip and the resulting market power is durable, thus the cost of delaying action can be very large. Yet, antitrust laws and their application by the courts seem to follow an outdated paradigm. There is a need to update antitrust laws for the Digital Age, introducing better analytical tools to take into account the impact of potential and nascent competitors, and to deliver enforcement that protects competition on the merits, and prevents exclusionary conduct.

The Stigler Report details the particular areas where antitrust law needs reform. Two areas, however, are particularly important to the subject of this hearing. The first reform consists in reassessing the review of startup acquisitions by digital incumbents. While an across-the-board prohibition of acquisitions would be unreasonable and counterproductive, we must ensure that digital platforms do not continue to squash nascent competition without challenge. In particular, the Stigler Report suggests amending notification thresholds to ensure that start-up acquisitions are submitted for review by antitrust authorities and inverting the burden of proof in these cases, requiring the platforms to demonstrate that the acquisition will not harm competition.

Maintaining an open, vibrant and innovative market will also require measures to reduce incumbents’ bottleneck power and to facilitate customer acquisition by new entrants. Thus, the second proposed reform consists of mandating interoperability in digital markets, so that competitors can offer their customers access to the dominant network. This strategy, which would diminish the problem of network externalities, is similar to that applied in telecom markets.

Finally, the Stigler Report suggests the creation of a digital authority with the power to 1) review even the smallest transactions involving digital businesses; 2) protect entrants and businesses on the platform from discrimination and exclusion; and 3) facilitate independent parties’ (such as Congress and civil society) access to digital platforms’ own data, to ensure that these platforms remain accountable.

I urge you to contemplate these ideas as you proceed with your consideration of policies to address problems in the digital marketplace. I also commend you again for bringing your attention to this important issue.

Sincerely,

Luigi Zingales

Faculty Director and Professor of Finance

George J. Stigler Center for the Study of the Economy and the State

University of Chicago Booth School of Business

The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.