If, as California political legend Jesse M. Unruh once quipped, “money is the mother’s milk of politicians,” it’s reasonable to expect that countries might wield their financial power for geopolitical purposes on the world stage. Accordingly, a fascinating new paper slated to be presented at the upcoming Stigler Center Political Economy of Finance conference tracks how China punishes countries whose heads of state accept meetings with the Dalai Lama by curbing bilateral lending flows from its state banks.

Diplomacy—the art of making up and breaking up on the global stage—is an important part of the geopolitical architecture, not only due to its role in maintaining peace and security but also because it has a bearing on global economic and financial outcomes. Diplomacy can take many forms, but in an age where money talks, the prospect of using their country’s banking system for diplomatic purposes is too irresistible for your average politician.

While political meddling in banking markets has a long and well–documented history in both developing and developed markets, little is known about the role banks (state-controlled banks in our case) play in international politics. With the economic rise of state-based capitalist systems like those of China and the oil–producing countries, so too has the importance of the state-bank channel of diplomatic influence increased.

To highlight this channel, consider the following example related to geopolitical events emanating from the Chinese province of Xinjiang. The Xinjiang region has had intermittent autonomy but was officially incorporated into the People’s Republic China in late 1949. The majority ethic population in Xinjiang is Muslim and their language is related to Turkish. In the 1990s, the collapse of the Soviet Union and the emergence of independent Muslim states in Central Asia led to a rise in open support for separatist groups and continuing ethic-based violence. One such incident in February 2012 resulted in 13 Han Chinese being killed. In a press statement following the incident, Xinjiang Province’s Party Chairman, Nur Bekri, declared “a thousand and one links” between local terrorists and Taliban forces in Pakistan. Two weeks later, the state-controlled Industrial and Commercial Bank of China withdrew a USD 1.6 billion loan to fund the Pakistan portion of the Iran-Pakistan cross–border pipeline.((See “Breakup time for Pakistan, China” by Raffaello Pantucci, June 7, 2012, The Diplomat: (accessed October 13, 2017).))

In our paper “Geopolitics and International Bank Flows” we find evidence that governments, more often than not, use state banks to allocate capital to favored nations and restrict capital when diplomatic relations deteriorate. Tracing out these flows is more challenging than it might first appear since we first need an accurate way to measure the quality of diplomatic relations between two countries, say, China and Australia. An ideal measure should be consistent over time and also free from influence from other countries. For example, a measure of Chinese-Australian relations should be free from the influence of any other country, say, the United States. Of course, these types of measures are hard to come by.

In our paper “Geopolitics and International Bank Flows” we find evidence that governments, more often than not, use state banks to allocate capital to favored nations and restrict capital when diplomatic relations deteriorate. Tracing out these flows is more challenging than it might first appear since we first need an accurate way to measure the quality of diplomatic relations between two countries, say, China and Australia. An ideal measure should be consistent over time and also free from influence from other countries. For example, a measure of Chinese-Australian relations should be free from the influence of any other country, say, the United States. Of course, these types of measures are hard to come by.

We therefore bring together two pieces of evidence to make our claim. First, we use United Nations (UN) General Assembly voting patterns to capture the extent of political relations between countries. A recent important example sheds some light on the plausibility of this approach. In June 2017, the United Kingdom suffered an embarrassing defeat in a UN vote over decolonization and its residual hold over the disputed Chagos Islands in the Indian Ocean. The UN vote saw delegates support the Mauritian-backed resolution to seek the opinion of the International Court of Justice in The Hague over the legal status of the islands. What is interesting is that 10 European Union (EU) countries (notably including Germany and France) broke the tradition of voting in line with their EU counterparts and abstained from voting—presumably due to the strained relations between these countries and the United Kingdom over Brexit.((See “EU members abstain as Britain defeated in UN vote on Chagos Islands” by Owen Bowcott, June 23, 2017, The Guardian. (accessed November 15, 2017).))

For a sample of 25 source countries and 76 recipient countries, we document that similarities in the pattern of voting for two countries is positively correlated with bank flows between those countries. Precisely, we find that if two countries’ voting aligns in a given year—in other words, if the two countries are ideologically similar and thus “get along”—then bank flows between these two countries are significantly higher the next year. Importantly, digging deeper, we find that the pattern in bilateral bank flows we document is concentrated in those countries where there is official state involvement in the banking sector: the state-bank channel.

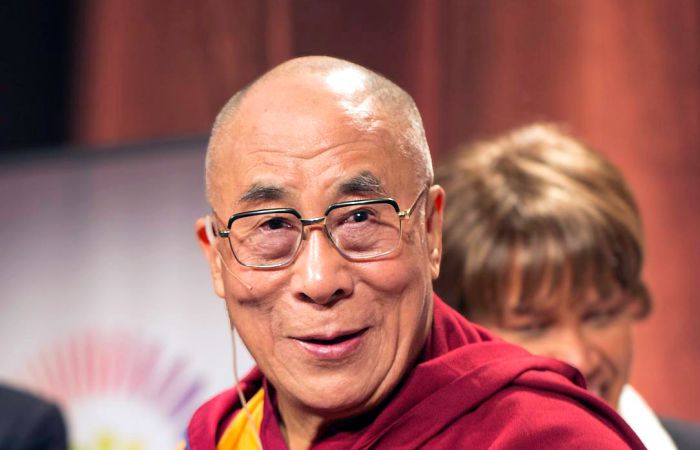

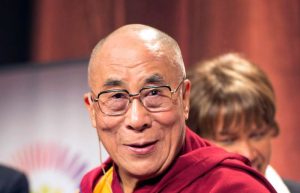

Our second piece of evidence focuses on a single country: China. Now the second largest economy in the world, China provides us with an ideal setting to study this question for two reasons. First, since China is an authoritarian regime, its administration has significant capacity to influence the lending decisions of its state-owned banking system. Second, focusing on China provides us with a unique source of time-varying political tension between China and other countries: the status of Tibet and the Dalai Lama. The Chinese government considers the status of Tibet as an internal affair and outside interference is not tolerated. As a result, each time the Dalai Lama travels, as he frequently does, the Chinese government threatens that engagement between the Dalai Lama and political officials in the host country will be met with animosity and will ultimately harm relations.

The seriousness of this matter to the Chinese government is exemplified by the following case. In 2012, the British Prime Minister, David Cameron, chose to meet with the Dalai Lama during his visit to the United Kingdom despite staunch opposition from the Chinese authorities. The result: China put diplomatic relations into a deep freeze—Cameron could not visit China and Chinese officials refused to meet with him for over 14 months.((See “China unhappy at Cameron’s meeting with Dalai Lama”, May 15, 2012, The Guardian. (accessed October 9, 2017).)) The standoff between Cameron and China only ended when he announced in Parliament that “we do not support Tibetan independence, and respect China’s sovereignty” and reassured China that he would not meet with the Dalai Lama again.((See “How David Cameron’s comments to MPs over Tibet ended a 14-month stand-off with China” by Christopher Hope, June 27, 2013, The Telegraph (accessed October 9, 2017).))

With this episode in mind, we track the Dalai Lama’s footsteps and examine whether bank flows from China to 76 host countries vary with the timing of his visits. Our estimates suggest that in the year following a visit where a senior public official (i.e., one who holds the title Prime Minister or President) personally meets with the Dalai Lama, bank flows from China to the host country fall by between 12 and 17 percent relative to otherwise similar countries. Further, the effect is short-term, lasting only one year. These findings are exemplified in Figure 1, where we plot the difference in the average percentage change in Chinese bank flows between treated countries and control countries (i.e., those where the Dalai Lama met with a senior public official versus those where the Dalai Lama visited but did not meet a senior public official, or where the Dalai Lama did not visit at t-1) from t-2 till t+2.

If we focus on the solid blue line, which plots the difference in means (the red line plots the difference in medians), we can see the following. First, between t-2 and t-1 the line is virtually flat, implying that treated and control groups had very similar trends prior to a Dalai Lama meeting the head of state. Second, following the visit, Chinese bank flows fall significantly relative to the control group between t-1 and t—the size of the fall is about 16 percent, which is inside our range of estimates noted above. Third, between t and t+2 we see a reversal in the geopolitical effect.

Our research shows that governments can influence the global allocation of bank credit via state-controlled banks, which has important implications for both economic and political outcomes. While our finding of systematic interference in banking markets by governments for diplomatic reasons is new, perhaps it is not surprising. After all, as American politician Jesse Marvin Unruh once said, “Money is the mother’s milk of politicians.”

Kun Li and Phong Ngo are both with the Research School of Finance, Actuarial Studies and Statistics, which is part of the College of Business and Economics at The Australian National University.

Disclaimer: The ProMarket blog is dedicated to discussing how competition tends to be subverted by special interests. The posts represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty. For more information, please visit ProMarket Blog Policy.