In the last few decades, numerous studies in financial literature have been devoted to the question of “alpha”—that is, the ability of money managers to beat market returns. The main finding is that most asset managers fail to beat the market, and high active management fees are the main culprit. Yet, many investors still choose to give their money to active money managers in the hope that they will beat the market. Researchers at the University of Michigan and the University of New South Wales used a novel dataset to come up with another possible criterion for managers who have a higher probability of beating the market: their parents—specifically, the affluence of their background.

Mutual funds managers who come from poor families outperform managers from rich families. Specifically, the former deliver a higher alpha for their investors. This is the main finding of a recent paper by Oleg Chuprinin from the University of New South Wales and Denis Sosyura from the University of Michigan, “Family Descent as a Signal of Managerial Quality: Evidence from Mutual Funds.” Chuprinin and Sosyura argue that, because they face higher barriers to entry, managers coming from poor families are more skilled. ((Oleg Chuprinin and Denis Sosyura, “Family Descent as a Signal of Quality: Evidence from Mutual Funds”, NBER Working paper #22517 (2016).))

In practical terms, Chuprinin and Sosyura found that, based on a four-factor alpha, fund managers in the bottom quintile of the sample outperform fund managers in the top quintile by 2.16 percent annualized (at a significance level of 1 percent). Chuprinin and Sosyura also found that the chances of promotion of managers from rich families are less performance-dependent than those of managers from a more modest background.

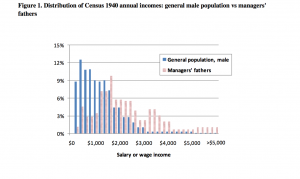

The data used in the study is based on the 1940 federal census, which provides information related to parents’ assets, wages, education, employment, location, and other relevant data. The financial data was extracted from Morningstar records from 1975 to 2012. Data regarding the managers’ education was also collected, including SAT scores and other university-specific data such as admission rates and average tuition.

In order to create a homogenous sample, the study focuses on actively managed American funds that specialize in US equity. The sample only includes managers with at least 24 monthly return observations. Additionally, due to legal restrictions related to identifying specific people in publicly available records, the study’s sample includes only fund managers that were born in 1945 or before, i.e. individuals who are at least 71 years old today. This means that the observations are not recent. These and other selection criteria and data limitations created a sample of 267 managers that managed 482 unique funds.

However, Chuprinin and Sosyura emphasize that they do not imply that “managers born poor are ex ante more skilled or grow to be more skilled.” Rather, they say that “candidates from wealthy families face less stringent screening standards and, for a given level of skill, are more likely to be appointed managers. On the other hand, unskilled candidates from poor families are filtered out and only the skilled ones make it into the sample.”

For the purpose of analyzing promotion, the authors defined two events that would constitute a promotion: (1) if the number of funds a manager manages increases, or (2) if the dollar value of the assets managed increases two-fold or more in one month. The result is that, in order to stand the same chance of promotion, managers from the 25th percentile of wealth need to outperform managers from the 75th percentile by as much as 6.6 percent annually, which is practically unattainable.

In an email correspondence with ProMarket, Sosyura and Chuprinin answered questions about their paper:

Guy Rolnik: Your main conclusion is that managers from poorer families perform better. But how can investors know if the managers of their funds are from richer or poorer families?

Denis Sosyura and Oleg Chuprinin: Funds or their managers, of course, are not obligated to disclose this information. So, fund investors cannot directly observe the manager’s family descent. This can explain why we do not find a significant relationship between the manager’s wealth and fund flows, over and above the effect of managers’ performance. However, a careful investigation of the manager’s background, similar to the one undertaken in this study, can provide useful information on managerial quality, incremental to that reported in public filings.

GR: You note that managers born poor are not, ex ante, more skilled or grow to be more skilled. Doesn’t this imply that, if the screening process changes, this signal would be lost?

DS&OC: Indeed, if the screening becomes more egalitarian, the signal would be lost. Once the data on new generations of managers (from later census records) become available, one can test how the strength of the signal varies over time as hiring and promotion policies evolve.

GR: Supposing that investors can differentiate between fund managers’ economic backgrounds, would it also be correct to say that the more investors use this signal the less powerful it would become?

DS&OC: This is correct under the assumption (generally supported by empirical evidence) of diminishing returns to investment activity. As funds run by more skilled managers attract more flows and become bigger, their performance declines.

GR: Assuming investors do not know which managers came from poorer families, their employers do know. How can they use information in an asymmetrical way?

DS&OC: It is difficult to say for sure, but employers might prefer managers from privileged background for reasons not directly related to observable fund performance (e.g., to increase lobbying power or to pursue private interests, such as connecting with influential families).

GR: Because of privacy limitations, all managers in your sample were born in 1945 or before, which means that the youngest are 71 years old now and that their fund-managing careers ended many years ago. Isn’t it possible that things have changed dramatically since then—specifically the screening process?

DS&OC: Absolutely. One can think of this study as describing the origins of the investment management industry, which is still relatively young. Things are changing continuously due to improving technology, changing social perceptions, updates in regulation, and changes in the competitive landscape.

GR: You point to the better performance of fund managers that were born to poorer families. Have you checked if they were able to pass this trait to their children?

DS&OC: We do not have data on their children’s occupations or performance.

GR: Do your results suggest that perhaps wealthy families should educate their children differently?

DS&OC: Our results do not imply that. It is possible (and even likely) that children from wealthy families are adequately educated and are better performers, on average, than those from poor families. What we say is that this average comparison does not apply when we introduce a biased selection process, in which only the best-performing individuals with poor backgrounds are selected.

GR: Were all fund managers in the sample men?

DS&OC: We also have female managers in the sample, but their fraction is small.

GR: You have included funds that had at last $10 million in assets. Have you found a connection between funds’ assets and chances of outperforming? Maybe poor managers do better or worse in smaller funds?

DS&OC: We consistently find that smaller funds earn higher returns, consistent with the diminishing returns to scale in investment. The difference in performance between poor and rich managers, however, does not appear to be related to fund size.

GR: Does the performance of managers from poor families also stand out when they are part of a team?

DS&OC: To ensure a one-to-one correspondence between fund managers and performance outcomes, we focus only on solo-managed funds.

GR: One of your explanatory variables is universities’ admission rates as a proxy for exclusivity and quality. Weren’t you worried that perhaps some universities encourage 18-year-olds to apply so that the admission rate would be lower, thereby signaling that these universities may be of high quality?

DS&OC: We consider several characteristics of university quality and they are consistent with each other. For example, lower admission rate correlates strongly with high SAT scores.

GR: Have you considered links between performance and other variables, such as specific investment banks, the degree of use of computers, specific market segments, geographical office locations, race, religion, etc.?

DS&OC: This analysis is difficult to undertake in view of sample and data constraints. So far, we have not been able to identify a reliable connection between the performance differential and a specific market segment.