Regulation and reputation are not independent of each other. Regulation can substitute, crowd out, or even implement the power of reputational concerns. A better understanding of the fuzzy interactions between regulation and reputation is needed before jumping into policy implications

The 2007-2009 global financial crisis spawned a vast “what went wrong” literature. While most of the literature focuses on lack of moral or legal controls, a few prominent voices spotlight the demise of reputational concerns. Instead of failures of regulation, they emphasize failures of reputation. From Nobel laureates George Akerlof and Robert Shiller((George A. Akerlof & Robert J. Shiller, Phishing for Phools (2015), at Chap. 2 (focusing on “reputation mining” by rating agencies).)), to Yale’s Jonathan Macey((Jonathan Macey, The Death of Corporate Reputation (2013).)), to Berkeley’s Steven Davidoff and the New York Times DealBook column((Steven Davidoff Solomon, As Wall St Firms Grow Their Reputations Are Dying, N. Y. Times, 26 Apr. 2011.)), the overarching theme runs as follows: Once upon a time, players in the financial market cared about maintaining a reputation for integrity, which in turn deterred them from engaging in shenanigans. But then at some point during the last couple of decades, these companies and businessmen stopped caring. They started “defecting” on each other with little regard to losses in their reputation cache. The result was systemic failures and loss of trust.

To be sure, claims about the relative strength of reputational concerns are hard to prove, as reputation follows fuzzy dynamics and is hard to capture in neat models or empirical work. But even if you are convinced (by logic/life experience/suggestive evidence) that reputation has indeed died as a system of control((One could muster logic and evidence to support at least two alternative stories: first, that reputation never mattered much in face of strong economic incentives. And, second, that reputation still lives on, albeit with different features such as more emphasis on reputation for technical competence rather than reputation for integrity.)), the key question still remains: who killed it? The “who killed reputation” question is more than just a compelling whodunit thought experiment. The way you answer it generates important policy implications.

Most accounts, like Akerlof and Shiller’s, or Davidoff’s, seem to attribute the demise of reputational control to changes in the surrounding business environment: key financial players switched from partnerships to publicly traded structures, increased in size, opacity, and complexity, and started playing the role of middlemen in ways that open up conflicts of interests. If you side with these explanations, then you will be more likely to favor some form of regulation—either to mitigate the effects of these new features on reputation, or to compensate for, and substitute, the decline in non-legal (reputational) deterrence with legal deterrence.

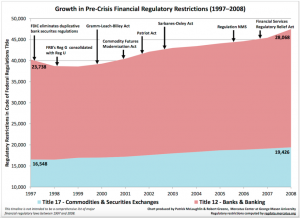

Macey, however, locates the culprit elsewhere: regulation killed reputation, he tells us. The constant rise of regulation in the years leading to the crisis has crowded out the incentives of financial sector players to build, rely on, and maintain good reputations. If you side with Macey’s version, then you will be more likely to point in the opposite direction—deregulation as the answer. After all, Macey argues that the crisis did not result from too little regulation but rather too much of it. Reducing government intervention may end up improving overall deterrence by letting the more informal, reputational systems of control regain their strength.

I think that Macey is right to spotlight the interactions between systems of control: legal intervention affects non-legal sanctions and rewards, sometimes in ways that reduce the overall effectiveness of governance. But I am not ready to make the jump to the “deregulation will make deterrence better” argument, if only for the two following reasons.

First and most basically is the old adage “correlation does not prove causation.” Even if we accept that a rise in regulatory intervention coincided with a decline in the power of reputational concerns, it does not mean that the former caused the latter. In fact, there exists a simpler explanation for the two phenomena to coincide, rooted in University of Chicago’s Gary Becker’s basic economic theory of deterrence((Gary S. Becker, Crime and Punishment: An Economic Approach, 76 Journal of Political Economy 169 (1968).)). For a system of sanctioning to deter misbehavior, the expected sanction (that is, the probability of detection multiplied by magnitude of sanction imposed) cannot be lower than the temptation to defect. Changes in financial markets over the recent decades have pushed one side of the equation—the private benefits to be netted from sucker-punching your counterparties—to great magnitudes. Holding probability of detection constant, such increases in the temptation to defect generate demand for a system of governance with tougher sanctions. And this is the one feature where the legal system dominates non-legal systems of control. While non-legal systems (social norms, reputation, internal morals) are usually more flexible and less costly upfront, they are unable to impose heavy sanctions such as taking your liberty or property((Steven Shavell, Laws vs. Morality as Regulators of Conduct, 4 American Law and Economics Review 227 (2002).)). In other words, increases in the temptation to misbehave and in social harms caused by misbehavior shift the demand for both legal control (increasing it) and reputational control (decreasing it). Reducing legal intervention will not magically make the expected reputational sanctions big enough to single-handedly deter misbehavior in markets with opaque activity and super-strong temptations to defect.

Second, legal control does not necessarily crowd out reputational control; it sometimes even improves the quality of reputation markets((I develop this argument elsewhere: Roy Shapira, A Reputational Theory of Corporate Law, 26 Stanford Law & Policy Review 1 (2015); Roy Shapira, Reputation through Litigation: How the Legal System Shapes Behavior by Producing Information, 91 Washington Law Review (forthcoming, 2016).)). Disclosure requirements can help surface information that leads to more accurate reputational sanctioning and rewards. Litigation and regulatory investigation provide market participants with more fact-based, nuanced versions of alleged misbehavior. And information intermediaries, such as mass media or stock anal

ysts, can and do use information generated by the legal system to make informed decisions on which companies to trust. Proposals to reduce legal intervention should therefore take into account the indirect costs of potentially hurting reputation by reducing the information flow (from the courtroom to the court of public opinion).

Instead of using the reputation argument to call for more or less legal intervention, we should use it to reevaluate the design of legal intervention. Macey, for example, is right to point out the problem with the Securities and Exchange Commission’s (SEC) enforcement practices. When the SEC files enforcement actions against virtually all companies in an industry (only to settle them immediately with neither-admit-nor-deny agreements), the reputational value is close to zero. Reputational sanctions, after all, rest on third parties hearing about one company’s misbehavior and taking their business elsewhere. If all your competitors are facing similar legal enforcement, you are less fearful of the prospect of diminished business opportunities.

Finally, we should delve deeper into other causes of the purported demise of reputational control. It cannot be just regulation. A place to start is along the chain of creating and disseminating information on financial-sector players’ behavior. For example, what happened to the financial media in the years leading to the crisis? In recent weeks the ProMarket blog featured a series of studies, columns, and interviews pointing to the possibility that the media lost its incentives and ability to generate, screen, and widely disseminate information that feeds reputation markets. For example, Chicago’s Luigi Zingales presented evidence suggesting dependence of media on the banks; Chicago’s Guy Rolnik suggested that the current business model makes it extremely hard for the media to speak truth to power; and longtime journalist and communications scholar Dean Starkman decried the decline in “accountability journalism” among the business media.