A study by Kenneth R. Ahern and Denis Sosyura ranks M&A reporters based on their accuracy.

Rumors and speculation have always been a part of the M&A market, with their effect on stock prices best exemplified by the old adage “buy the rumor, sell the news.” But in recent years, intense competition between media outlets trying to scoop each other has contributed to a rise in speculative reporting.

Readers looking for accurate reporting on mergers and acquisitions would be wise to take notice of the articles’ authors, according to a 2015 paper by Kenneth R. Ahern of the University of Southern California and Denis Sosyura of the University of Michigan.

The paper, titled Rumor Has It: Sensationalism in Financial Media (published in the Review of Financial Studies 2015), looks into the accuracy of the business press in the context of M&A scoops. Its aim, according to the authors, is to “challenge the view that the business press is a passive conduit of financial information” and show that the media has an incentive to attract readers through speculative reporting.

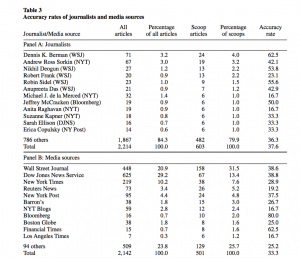

In order to measure the accuracy of M&A reporting, Sosyura and Ahern examined 2,142 articles by 382 journalists, which covered 501 rumored mergers about 354 target firms, among them large public firms like American Airlines and Alcoa and also smaller private firms. They defined a story as accurate if it was followed by an official takeover bid within a year. Of the 501 rumored mergers, a third matched that description.

As part of the study, Ahern and Sosyura published a ranking of the most accurate M&A reporters and news outlets:

The tables seem to confirm the intuitive conclusion that the more established a journalist is, the more likely it is that his or her reporting on rumored mergers will turn out to be accurate. Ahern and Sosyura found that the most accurate M&A reporters (that is, reporters whose articles on prospective M&A deals turned out to be true), are older, have journalism degrees, and specialize in the industry of the companies whose mergers they’re reporting on.

Location also matters, they note, as the most accurate M&A reporters are based in New York. “This could occur because the best business journalists end up in New York, or because New York-based journalists have better connections to Wall Street insiders,” they write.

This last point might raise the question of whether accuracy is a result of access, and whether M&A reporters working for more reputable outlets such as the Wall Street Journal and the New York Times find it easier to gain access to insider sources.

“We do not have a reliable way to separate these effects because we can only observe a journalist’s industry affiliation and location. A journalist’s access to information often depends on the quality of their professional network and access to industry insiders,” says Sosyura, assistant professor of finance at the University of Michigan.

He adds: “If an insider wants to leak information to the press, they are more likely to bring it to a more reputable source like the New York Times or the Wall Street Journal, because these outlets reach a wider audience and have more impact. At the same time, it could be that the journalists at the New York Times or the Wall Street Journal are more skilled, have better connections to the industry, or have more resources for investigative journalism.”